Creating a trading robot (also known as Expert Advisor or EA) for MetaTrader 4 (MT4) involves writing a program in MetaQuotes Language 4 (MQL4). Here is a basic guide to help you get started:

- Learn MQL4: Familiarize yourself with MQL4, the programming language used in MT4 for creating Expert Advisors. You can find the MQL4 documentation on the MetaQuotes website.

- Access the MetaEditor: MetaEditor is the integrated development environment (IDE) for writing MQL4 code. Open it by clicking on “Tools” and then selecting “MetaQuotes Language Editor” in the MT4 platform.

- Create a New Expert Advisor: In MetaEditor, go to “File” -> “New” -> “Expert Advisor (template)”.

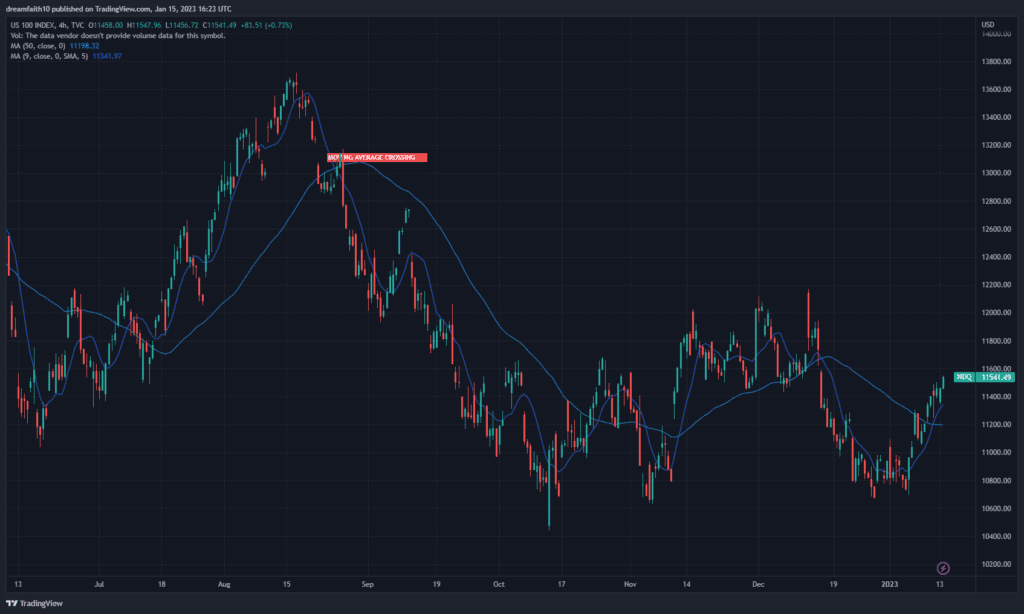

- Write Your Trading Strategy: Define the rules of your trading strategy in the code. Specify conditions for opening and closing trades based on technical indicators, price movements, or any other criteria you want to implement.Here’s a simple example:mql4Copy code

// Sample Moving Average Crossover Strategy int start() { if (iMA(Symbol(), 0, 10, 0, MODE_SMA, PRICE_CLOSE, 0) > iMA(Symbol(), 0, 20, 0, MODE_SMA, PRICE_CLOSE, 0)) { // Buy condition OrderSend(Symbol(), OP_BUY, 1, Ask, 3, 0, 0, "Buy Order", 0, 0, Green); } else if (iMA(Symbol(), 0, 10, 0, MODE_SMA, PRICE_CLOSE, 0) < iMA(Symbol(), 0, 20, 0, MODE_SMA, PRICE_CLOSE, 0)) { // Sell condition OrderSend(Symbol(), OP_SELL, 1, Bid, 3, 0, 0, "Sell Order", 0, 0, Red); } return(0); } - Compile the Code: Click on the “Compile” button in MetaEditor to check for any syntax errors and compile the code into a format that MT4 can understand.

- Test Your Expert Advisor: Go back to the MT4 platform, open the “Navigator” window, right-click on “Expert Advisors,” and choose “Refresh.” You should see your newly created EA. Drag and drop it onto a chart to apply your strategy.

- Optimize and Refine: Test your EA in a demo environment to see how it performs. You may need to optimize parameters and refine your strategy to improve its effectiveness.

- Backtesting: Use the built-in backtesting feature of MT4 to test your EA on historical data. This helps you evaluate its performance under various market conditions.

- Deploy in Live Markets: Once you are satisfied with the performance of your EA, you can deploy it in live markets with caution. Start with a small amount of capital and monitor its performance closely.

Remember that algorithmic trading involves risks, and it’s essential to thoroughly test and understand your strategy before using it in live trading. Additionally, consider consulting with financial professionals and doing extensive research before deploying trading algorithms in real-market scenarios.