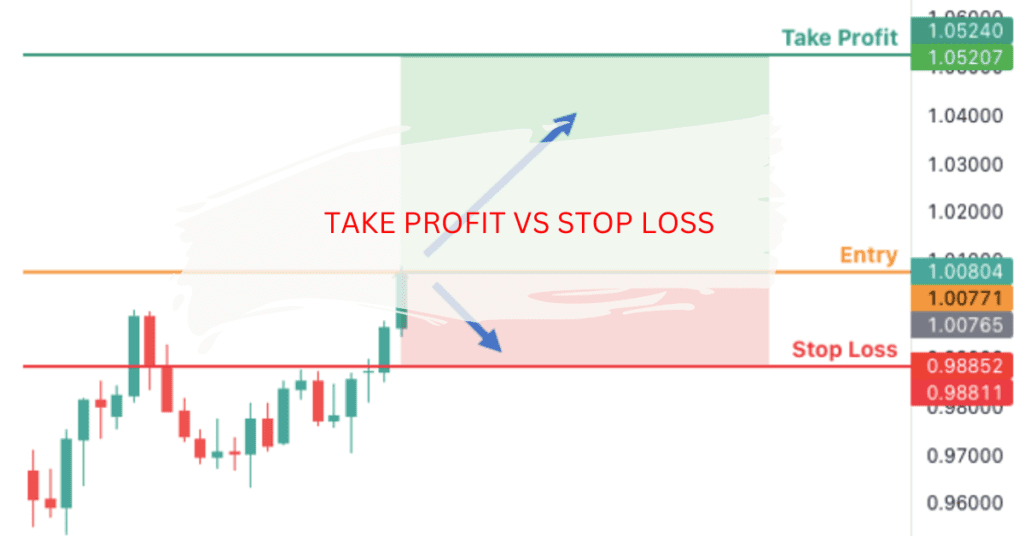

Take profit and stop loss are terms used in the context of trading financial instruments, such as stocks, currencies, or futures contracts.

A take profit order is an order to sell a security when it reaches a certain price, known as the take profit price.

This is used to lock in profits on a trade. For example, if you buy a stock for $100 and set a take profit order at $105, the order will be executed when the stock reaches $105, and you will sell it for a profit of $5 per share.

A stop loss order is an order to sell a security when it reaches a certain price, known as the stop loss price. This is used to limit potential losses on a trade. For example, if you buy a stock for $100 and set a stop loss order at $95, the order will be executed when the stock reaches $95, and you will sell it for a loss of $5 per share.

Both take profit and stop loss orders can be used to manage the risk of a trade and help traders achieve their investment goals. They are typically used in conjunction with each other, with the take-profit order being set at a higher price than the stop-loss order.

This way, if the trade goes in the trader’s favor, they can lock in profits at the take profit price, but if the trade goes against them, they can limit their losses at the stop loss price.

| Take Profit Order | Stop Loss Order |

|---|---|

| Used to lock in profits | Used to limit potential losses |

| Triggered when the security reaches the take profit price | Triggered when the security reaches the stop loss price |

| Can be used to manage risk and achieve investment goals | Can be used to manage risk and achieve investment goals |

| Typically set at a higher price than the stop loss order | Typically set at a lower price than the take profit order |

Take profit and stop loss orders are both useful tools for managing the risk of a trade and achieving specific investment goals. They can help traders to minimize potential losses and maximize potential profits, depending on the price movements of the security being traded.