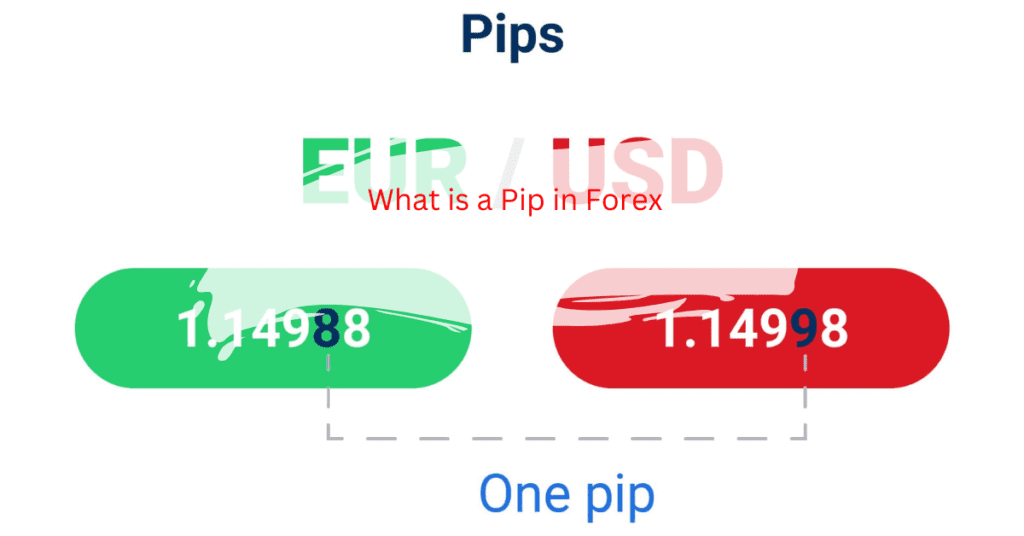

In the Forex market, the term “pip” refers to a change in the value of a currency pair. It is a unit of measure used to denote the change in value between two currencies. A pip is typically the fourth decimal place of a currency pair, though there are some exceptions to this rule. For example, if the EUR/USD currency pair moves from 1.1010 to 1.1011, this would be considered a one-pip movement.

READ MORE: WHAT IS SPREAD IN FOREX TRADING?

In the Forex market, pips are used to calculate the profits or losses of a trade. When a trade is executed, the difference between the purchase price and the selling price is the profit or loss on the trade, and this is typically expressed in pips. For example, if a trader buys the EUR/USD currency pair at 1.1010 and sells it at 1.1011, they would have made a profit of one pip.

Pips can also be used to express the size of a trade. For example, a trader might say that they are “long 100 pips on the EUR/USD.” This means that they have bought the EUR/USD currency pair and are hoping for a 100 pip appreciation in its value.

It’s important to note that the value of a pip can vary depending on the size of the trade. For example, a one-pip movement on a trade with a lot size of 100,000 currency units (a standard lot) is worth 10 units of the quote currency (in this case, USD). However, on a trade with a lot size of 10,000 currency units (a mini lot), the same one-pip movement would only be worth 1 unit of the quote currency.

Thanks for visiting FOREX GOATS kindly visit us again.