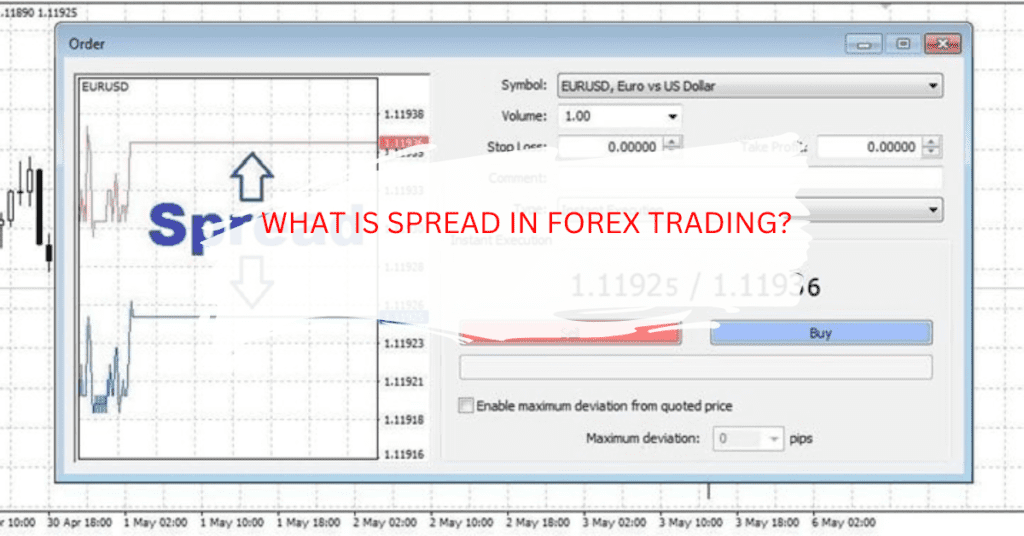

In forex trading, the term “spread” refers to the difference between the bid price and the ask price for a currency pair. The bid price is the price at which the market is willing to buy a currency, while the ask price is the price at which the market is willing to sell a currency.

READ MORE: 7 Steps to start Trading forex for absolute beginners

The spread is essentially the cost of trading a particular currency pair, and it is usually measured in pips, which is the smallest unit of price movement for a currency pair.

For example, if the bid price for the EUR/USD currency pair is 1.2050 and the ask price is 1.2055, the spread would be 5 pips. If a trader were to buy the EUR/USD at the ask price of 1.2055 and then sell it at the bid price of 1.2050, they would lose 5 pips on the trade.

In general, spreads tend to be wider for currency pairs that are less liquid or more volatile, and narrower for currency pairs that are more liquid or less volatile. Many forex brokers offer tight spreads, especially for the major currency pairs, which can help to reduce the cost of trading for their clients.

Thanks for visiting FOREX GOATS kindly visit us again.